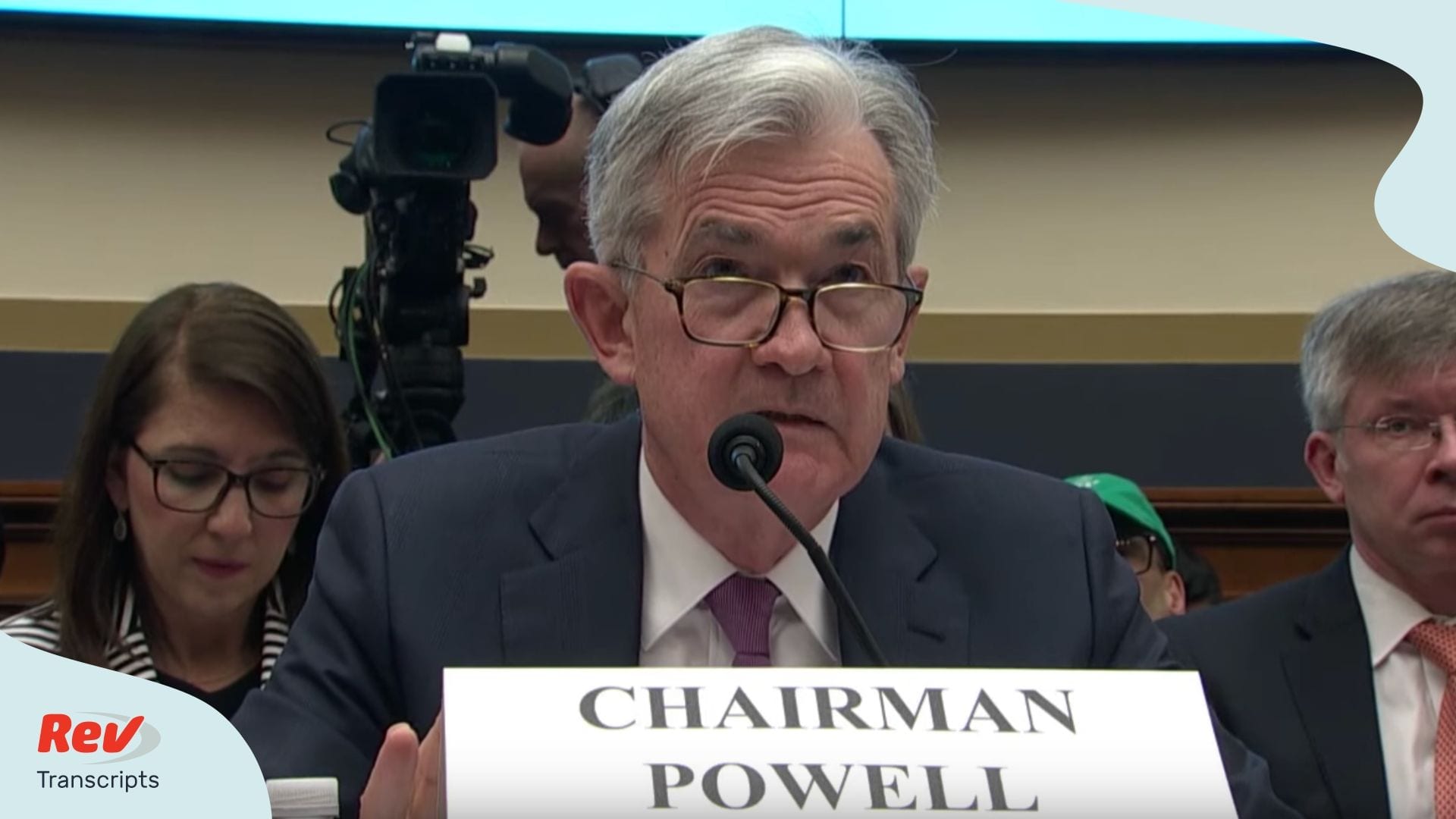

The U.S. Central bank’s most recent moves — which incorporate slicing loan fees to zero — merit commendation, despite the fact that the American economy could in any case head into a downturn given the vulnerability around the coronavirus flare-up, a previous Fed official said.

“I think recessionary conditions are definitely a risk and we’re dealing with so much uncertainty now on how this virus situation unfolds and what the economic impact turns out to be, nobody really knows,” Dennis Lockhart, Atlanta Fed president from 2007 to 2017, “Squawk Box Asia”.

“I think we should applaud the Fed for, in a way, getting as much ahead of the curve as they can,” he included.

The Fed on Sunday declared a suite of measures planned for padding the U.S. economy from the infection flare-up. Those measures incorporate bringing down the Fed subsidizes rate focus to somewhere in the range of 0% and 0.25% — an entire rate point lower — and propelling a $700 billion program to purchase Treasurys and home loan sponsored protections.

That declaration came under about fourteen days after the Fed cut its objective for its benchmark finances rate by 50 premise focuses to somewhere in the range of 1% and 1.25%, in another unexpected move.

The Fed and numerous national banks the world over have sliced financing costs to relieve the monetary effect of the new coronavirus flare-up. COVID-19 has contaminated in excess of 150,000 individuals and executed in any event 5,746 individuals all inclusive, as per the World Health Organization.

Lockhart said the Fed has now “spent all their bullets from an interest-rate cut point of view.” It is not yet clear whether that will leave the national save money with less alternatives to help the U.S. economy later on, he included.

Prior to the Fed’s proceeds onward Sunday, Goldman Sachs investigators downsized their conjecture for the U.S. economy. The investigators said they anticipate the U.S. economy to enlist zero development in the primary quarter, contract by 5% in the subsequent quarter before recuperating pointedly for the remainder of 2020.

Different experts said it’s difficult to tell whether the most recent moves by Feb could support the U.S. stay away from a downturn.

Randy Kroszner, who was a Fed representative from 2006 to 2009, said the Fed despite everything has some different apparatuses they can utilize other than cutting loan fees. However, different measures, including financial and administrative strategies, are expected to defeat such “extraordinary circumstance.”

“The Fed can do a lot to provide liquidity to do the markets, but it can’t solve a disruption in supply chain, it can’t cure a virus,” he told “Squawk Box Asia” on Monday.

He included that it’s “crucial” for strategies on both government and state level in the U.S. to concentrate on medical problems by ensuring the social insurance division has the important gear and mastery with the goal that individuals can get tried.

Furthermore, strategies ought to likewise concentrate on some “economic support issues”, for example, helping individuals who lost their positions, he said.

“The key is not just spending money but spending money in a way that is focused on trying to help the problems,” said Kroszner.

- What’s new with Glockboy LA - November 23, 2021

- Dr. Marjan Assefi, Dr. Soheila Nankali, and Dr. Nicole Jafaritalked aboutPCO - November 8, 2021

- Music Entrepreneur Siavash Aghaiepour on Celebrity Management - September 18, 2020